Some Known Incorrect Statements About Personal Loans Canada

Some Known Incorrect Statements About Personal Loans Canada

Blog Article

The Personal Loans Canada Statements

Table of ContentsSome Known Details About Personal Loans Canada The Ultimate Guide To Personal Loans CanadaThe Best Strategy To Use For Personal Loans CanadaSome Ideas on Personal Loans Canada You Should KnowHow Personal Loans Canada can Save You Time, Stress, and Money.

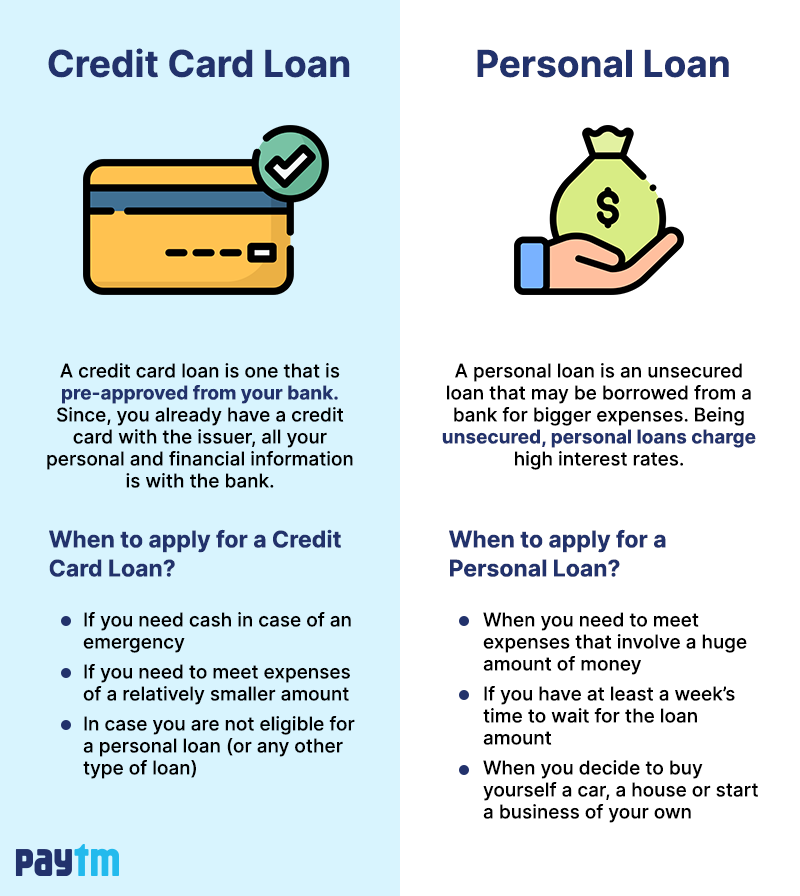

Allow's dive into what an individual car loan in fact is (and what it's not), the reasons individuals utilize them, and exactly how you can cover those insane emergency expenses without tackling the burden of financial obligation. A personal loan is a lump amount of money you can borrow for. well, virtually anything.That doesn't include borrowing $1,000 from your Uncle John to assist you pay for Christmas offers or letting your roommate area you for a couple months' rent. You shouldn't do either of those points (for a variety of factors), yet that's technically not a personal financing. Individual lendings are made via an actual financial institutionlike a bank, lending institution or online lending institution.

Allow's take an appearance at each so you can recognize precisely how they workand why you don't require one. Ever.

The Only Guide for Personal Loans Canada

Stunned? That's fine. Regardless of exactly how excellent your credit report is, you'll still need to pay rate of interest on a lot of individual lendings. There's always a price to spend for borrowing money. Protected individual car loans, on the other hand, have some type of security to "safeguard" the finance, like a watercraft, fashion jewelry or RVjust among others.

You can additionally take out a protected personal financing utilizing your cars and truck as security. Depend on us, there's absolutely nothing safe concerning protected financings.

But simply due to the fact that the repayments are predictable, it doesn't suggest this is a bargain. Like we stated before, you're virtually ensured to pay interest on a personal car loan. Simply do the mathematics: You'll end up paying way a lot more over time by securing a loan than if you 'd just paid with cash

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)

All About Personal Loans Canada

And you're the fish hanging on a line. An installment car loan is an individual finance you repay in taken care of installations in time (generally when a month) up until it's paid in full - Personal Loans Canada. And don't miss this: You have to pay back the initial our website finance amount before you can borrow anything else

Don't be misinterpreted: This isn't the same as a credit report card. With credit lines, you're paying interest on the loaneven if you pay on time. This kind of loan is incredibly tricky because it makes you think you're handling your financial obligation, when actually, it's handling you. Cash advance.

This one obtains us provoked up. Why? Due to the fact that these businesses prey on individuals who can not pay their bills. And that's just incorrect. Technically, these are temporary finances that offer you your paycheck in advancement. That official statement may appear enthusiastic when you're in a financial wreck and require some cash to cover your bills.

Getting The Personal Loans Canada To Work

Why? Since things obtain genuine messy actual quick when you miss out on a repayment. Those creditors will certainly follow your pleasant grandmother that guaranteed the loan for you. Oh, and you should never ever cosign a finance for anyone else either! Not only might you obtain stuck to a financing that was never ever suggested to be yours to begin with, but it'll ruin the relationship before you can say "compensate." Depend on us, you don't desire to get on either side of this sticky circumstance.

All you're really doing is utilizing brand-new financial obligation to pay off old financial obligation (and expanding your lending term). Companies recognize that toowhich is specifically why so many of them use you loan consolidation lendings.

And it starts click for source with not obtaining any type of even more money. ever before. This is an excellent rule of thumb for any type of economic purchase. Whether you're thinking of obtaining an individual finance to cover that kitchen area remodel or your frustrating credit score card bills. do not. Taking out debt to pay for points isn't the way to go.

The smart Trick of Personal Loans Canada That Nobody is Talking About

And if you're thinking about a personal financing to cover an emergency, we obtain it. Obtaining cash to pay for an emergency situation only escalates the stress and anxiety and difficulty of the situation.

Report this page